Latest Version

Version

Tax 20262.6

Tax 20262.6

Update

June 19, 2025

June 19, 2025

Developer

iSensePlus

iSensePlus

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

Income Tax Calculator

Income Tax Calculator

Report

Report a Problem

Report a Problem

More About Income Tax Calculator

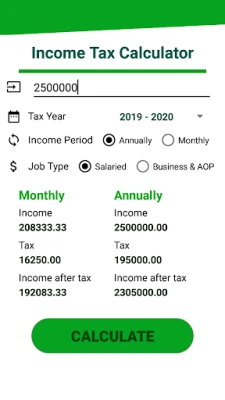

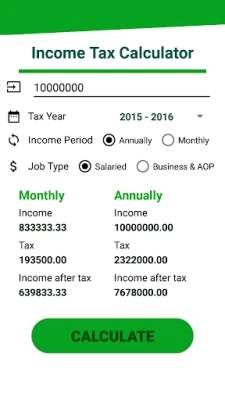

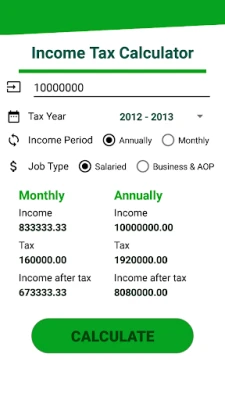

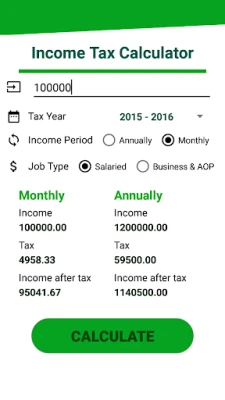

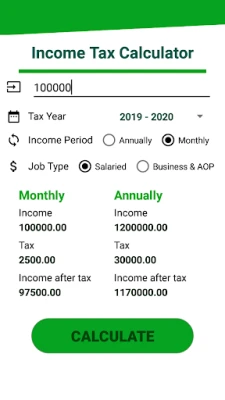

Income Tax Calculator for Individuals and Businesses (Pakistan)

Disclaimer: This is a privately developed application and is not an official government app. It is not affiliated with or endorsed by the Government of Pakistan or any of its departments. All tax information is based on publicly available sources, including the official website of the Federal Board of Revenue (FBR), and is provided for informational purposes only.

Information related to Tax is extracted from FBR website: https://fbr.gov.pk/ and this is the main source of information.

Overview:

Income Tax Calculator is an independent, easy-to-use app designed to help individuals and businesses in Pakistan estimate their income tax liabilities for the current and previous financial years. It uses tax slabs and formulas derived from publicly available information, including those published by FBR Pakistan, https://fbr.gov.pk/ .

This app is not an official tax filing tool and does not represent any government entity.

Key Features:

Calculate tax for financial years from 2013 to 2024

Offline functionality – no internet required

Simple interface; no login or personal data needed

Useful for salaried individuals, businesses, and AOPs

Provides general guidance based on standard tax rules and deductions

Who Should Use This App?

Salaried Individuals: Quickly calculate monthly and annual income tax

Business Owners & AOPs: Estimate tax on business income

Tax Professionals: Use as a quick reference tool

General Public: Understand potential tax obligations with minimal tax knowledge

Important Notice:

This app is not developed by or in partnership with any government agency.

The tax information is compiled from publicly accessible sources, including the FBR website, https://fbr.gov.pk/.

We strive for accuracy, but the app may contain typographical or technical errors.

Always consult a qualified tax advisor or official sources for final decisions or filing.

If you notice any discrepancies or outdated information, please reach out, and we’ll make corrections where necessary.

Information related to Tax is extracted from FBR website: https://fbr.gov.pk/ and this is the main source of information.

Overview:

Income Tax Calculator is an independent, easy-to-use app designed to help individuals and businesses in Pakistan estimate their income tax liabilities for the current and previous financial years. It uses tax slabs and formulas derived from publicly available information, including those published by FBR Pakistan, https://fbr.gov.pk/ .

This app is not an official tax filing tool and does not represent any government entity.

Key Features:

Calculate tax for financial years from 2013 to 2024

Offline functionality – no internet required

Simple interface; no login or personal data needed

Useful for salaried individuals, businesses, and AOPs

Provides general guidance based on standard tax rules and deductions

Who Should Use This App?

Salaried Individuals: Quickly calculate monthly and annual income tax

Business Owners & AOPs: Estimate tax on business income

Tax Professionals: Use as a quick reference tool

General Public: Understand potential tax obligations with minimal tax knowledge

Important Notice:

This app is not developed by or in partnership with any government agency.

The tax information is compiled from publicly accessible sources, including the FBR website, https://fbr.gov.pk/.

We strive for accuracy, but the app may contain typographical or technical errors.

Always consult a qualified tax advisor or official sources for final decisions or filing.

If you notice any discrepancies or outdated information, please reach out, and we’ll make corrections where necessary.

application description

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

VPN proxy - TipTop VPN TipTopNet

Rakuten Viber Messenger Viber Media

Turboprop Flight Simulator Pilot Modern Prop Planes

Yandere Schoolgirls Online Sandbox Multiplayer HighSchool

Highway Bike Traffic Racer 3D Motorcycle Rider Driving Games

SchoolGirl AI 3D Anime Sandbox Kurenai Games

Spirit Chat Grenfell Music

KakaoTalk : Messenger Kakao Corp.

ZOMBIE HUNTER: Offline Games 3D Shooting Apocalypse Gun War

Endless Learning Academy ABC,123,Emotions (Kids 2-5)

More »

Editor's Choice

Belet Video JAN tehnologiýa

VPN proxy - TipTop VPN TipTopNet

Highway Bike Traffic Racer 3D Motorcycle Rider Driving Games

ZOMBIE HUNTER: Offline Games 3D Shooting Apocalypse Gun War

Endless Learning Academy ABC,123,Emotions (Kids 2-5)

Spirit Chat Grenfell Music

Yandere Schoolgirls Online Sandbox Multiplayer HighSchool

JP Schoolgirl Supervisor Multi Saori Sato's Developer

SchoolGirl AI 3D Anime Sandbox Kurenai Games

Android

Android IOS

IOS Windows

Windows Mac

Mac Linux

Linux